Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

The Squeeze on Embraer

Subscription Required

Now open to all readers.

By Scott Hamilton

Introduction

April 27, 2020, © Leeham News: The collapse of the Boeing-Embraer joint venture Saturday resurfaces the squeeze Embraer was under when the deal was announced in 2018.

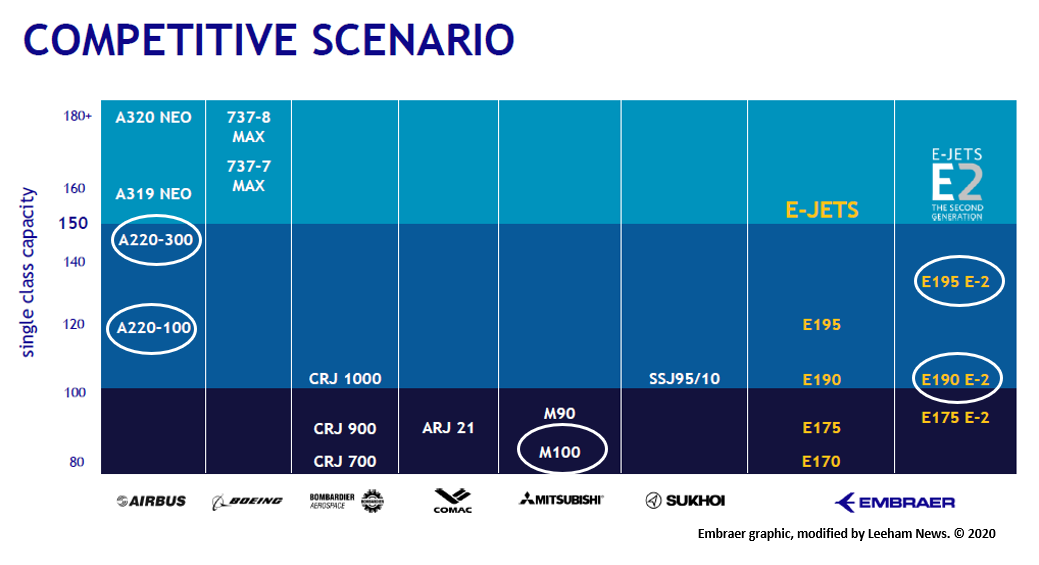

Then, Embraer faced the prospect of competing against Airbus in the 100-150 seat sector with the former Bombardier C Series.

Embraer’s E2 Jets are squeezed from above by the Airbus A220 and, if Mitsubishi performs, the M100 SpaceJet from the bottom.

John Slattery, the CEO of Embraer Commercial Aviation (ECA), said he could not compete against the marketing might of Airbus alone. In fact, he lost a key customer when jetBlue ordered the A220-300 instead of the E195-E2 to replace 60 E190-E1s. Airbus, which took over the C Series July 1, 2018, wrapped the A321neo into the A220 order. This deal was announced shortly after Airbus assumed majority ownership of the C Series program.

Summary

- E195-E2 will drive demand.

- The E190-E2 won’t be a “door opener.”

- The E175-E2 future depends on US Scope Clause relief.

- Coronavirus upends everything.

- M100 waiting in the wings.

Posted on April 27, 2020 by Scott Hamilton

Pontifications: Taking a knife to a gunfight

April 27, 2020, © Leeham News: There is a great line in the movie, The Untouchables. Sean Connery’s character tells an assassin that he’s bringing a knife to a gunfight.

That’s what came to mind when Embraer says it will seek remedies against Boeing following the latter’s terminating the joint venture agreement between the two companies.

In the movie, the assassin lured Connery into a trap. Connery was gunned down by a machine gun. But don’t expect Boeing to be lured into any trap by Embraer.

Boeing doesn’t pull a move like this without thinking through all the possibilities. It may muff the thought process, as will be noted below, but it does think through alternatives.

Posted on April 27, 2020 by Scott Hamilton

Embraer: Boeing wrongfully terminated JV, will seek remedies

April 25, 2020: (C) Leeham News: Embraer says Boeing wrongfully terminated the joint venture agreement due to its own problems and reputational damage.

“Embraer believes strongly that Boeing has wrongfully terminated the MTA, that it has manufactured false claims as a pretext to seek to avoid its commitments to close the transaction and pay Embraer the US$4.2 billion purchase price. We believe Boeing has engaged in a systematic pattern of delay and repeated violations of the MTA, because of its unwillingness to complete the transaction in light of its own financial condition and 737 MAX and other business and reputational problems.

“Embraer believes strongly that Boeing has wrongfully terminated the MTA, that it has manufactured false claims as a pretext to seek to avoid its commitments to close the transaction and pay Embraer the US$4.2 billion purchase price. We believe Boeing has engaged in a systematic pattern of delay and repeated violations of the MTA, because of its unwillingness to complete the transaction in light of its own financial condition and 737 MAX and other business and reputational problems.

Posted on April 25, 2020 by Scott Hamilton

Analysis: The collapse of the Boeing-Embraer joint venture

By the Leeham News Team

Analysis

April 25, 2020, © Leeham News: The Boeing-Embraer joint venture is off.

Boeing called off the JV, saying Embraer didn’t satisfy all the conditions required.

The impact to Embraer is more profound than to Boeing.

When the JV was announced in 2019, the advantages for Boeing were:

- Access to EMB engineers at a time when Boeing’s are aging and ready to retire.

- Access to much lower cost base in Brazil.

- KC-390 program.

- Revenue from EMB Commercial services.

- E2 program, though this is tangential.

The advantages for Embraer were:

- Access to Boeing’s vast customer base, marketing power, balance sheet (again, pre-virus) and capital markets.

- Access to work on new airplane programs: NMA (at the time), Future Small Airplanes (single aisle, either to compete with A220 or larger).

- Work for its engineers.

- A future beyond the struggling E2 and beyond the fanciful turboprop concept.

- A future for Embraer Commercial Airplanes, which in LNA’s view was increasingly risky.

Posted on April 25, 2020 by Scott Hamilton

Boeing walks from Embraer joint venture

By Scott Hamilton

April 25, 2020, © Leeham News: Boeing today pulled the plug on its proposed joint venture with Embraer. It claimed the Brazilian company failed to meet all the terms and conditions required of the JV agreement.

“Boeing has worked diligently over more than two years to finalize its transaction with Embraer. Over the past several months, we had productive but ultimately unsuccessful negotiations about unsatisfied MTA conditions. We all aimed to resolve those by the initial termination date, but it didn’t happen,” said Marc Allen, president of Embraer Partnership & Group Operations. “It is deeply disappointing. But we have reached a point where continued negotiation within the framework of the MTA is not going to resolve the outstanding issues.”

Global regulatory approval of the JV was won by nine of 10 regulators. But it has been held up by the European Union, which  repeatedly halted consideration while asking for more information. A June 23 target date for a decision was recently reset to August.

repeatedly halted consideration while asking for more information. A June 23 target date for a decision was recently reset to August.

The JV agreement provides for a $100m break up fee to be paid by Boeing if anti-trust approval isn’t forthcoming. By terminating the agreement early, Boeing hopes to avoid paying the fee, LNA is told.

Embraer is sure to protest and take an opposite position. Last month, the company said it continued to “take all the necessary actions” to complete the deal.

As recently as March 24, Boeing CFO Greg Smith “stressed the strategic value” of the partnership.

Posted on April 25, 2020 by Scott Hamilton

Pontifications: Airlines, OEMs step up in virus crisis

April 13, 2020, © Leeham News: There are plenty of stories and photos floating around the Internet about airlines flying empty or nearly so.

Schedules have been pared back up to 95% across the globe.

Spot-check Flightradar24 at any given moment and there are a lot air freighters flying.

But the passenger airlines are also flying some airliners dedicated to cargo. Some are flying cargo in the below-deck holds only. Others installed plastic protection over the passenger seats and loaded box after box after box of protective masks for shipment. Still others removed the passenger seats entirely and loaded the main deck with lighter-weight cargo.

This article summarizes many airlines that stepped up to fly supplies throughout the world.

Posted on April 13, 2020 by Scott Hamilton

Is COVID-19 a Force Majeure event?

Editor’s Note: Airbus, Boeing and Embraer and other OEMs face requests for deferrals and perhaps cancellations of orders as a result of COVID-19. In addition, Boeing now faces cancellation requests for the 737 MAX grounding, now in its 13th month. While Boeing’s contracts generally allow Boeing or the customer to cancel the order after the 12th month, the COVID crisis raises a new element: canceling by Force Majeure and something called the Doctrine of Frustration.

The following analysis appeared March 12, 2020, on the website of the law firm Shearman & Sterling law firm. The authors are listed at the end of this article. It is reprinted here with permission.

Following the rapid spread of the novel coronavirus (“COVID-19”) that was first reported in Wuhan, China at the end of 2019, the World Health Organization declared COVID-19 to be a pandemic on March 11, 2020.

In this note, we consider how force majeure provisions in commercial contracts and the related common law doctrine of frustration may be engaged in the context of the COVID-19 outbreak. While this analysis focuses primarily on the position under English law, we have included a PRC law perspective because of the significant impact COVID-19 has had on business in China. We also suggest steps that parties may take to safeguard their positions in view of the evolving situation.

Posted on April 9, 2020 by Scott Hamilton

Pontifications: Critical step in Boeing MAX recertification target: May

March 30, 2020, © Leeham News: Barring further issues, the FAA Type Inspection Authorization for the MAX is targeted for the second half of May, LNA learned.

This is a critical step in recertifying the airplane.

Also barring more unexpected events in a year filled with them, Boeing should resume production of the 737 MAX in May, LNA confirmed.

Posted on March 30, 2020 by Scott Hamilton

Embraer had a better 2019 than 2018

By Bjorn Fehrm

March 26, 2020, ©. Leeham News: Embraer presented its full-year 2019 results today and held an analyst call with the CEO, Francisco Gomes Neto, and the CFO, Antonio Carlos Garcia. The company posted a loss, but the underlying operational performance was a definite improvement over 2018.

The major part of the loss came from extra costs for the formation of a separate Commercial Aircraft division for the joint venture with Boeing. To understand Embraer’s position in these difficult times, we will separate the analysis of the 2019 results in three parts:

- The operational results for 2019

- The costs and effects of the carve-out for the Boeing joint-venture

- The actions by management to work through the Covid-19 crisis

Posted on March 26, 2020 by Bjorn Fehrm

HOTR: Boeing has options to federal bailout, CEO says

By the Leeham News Staff

March 25, 2020: First, Boeing CEO David Calhoun said he wasn’t an insider (after 10 years on the Board of Directors, and as lead director for many of them). No, he merely had a front row seat in the movie theatre.

Then he trashed his predecessor, Dennis Muilenburg, for stock buyback and dividend policies (that the Board approved).

Next, Boeing said it needs a portion of the $60bn in federal aid it requested for the aerospace industry.

Now, Calhoun appears to have put his foot in his mouth again. Or did he?

When asked about the possibility of the government taking an equity position in Boeing as a condition to a bailout, Calhoun said Boeing has options to federal money.

The Wall Street Journal wrote yesterday, “I don’t have a need for an equity stake,” Boeing CEO Calhoun said Tuesday on Fox Business Network. “If they forced it, we’d just look at all the other options, and we have got plenty.”

There’s a very practical reason for Boeing to object to government taking an equity stake. It would effectively shut down bidding on some key defense contracts.

But wait a minute: if you’ve got all these other options, why ask for a federal bailout for Boeing?

Or was this a message to the street that Boeing is OK?

Still, on CNBC’s Squawk Box, Calhoun said if the credit markets stayed closed for eight months, it would be tough for Boeing to remain healthy.

Posted on March 25, 2020 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008