Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Odds and Ends: CSeries timeline; KC-46A roll-out; China’s new airplane

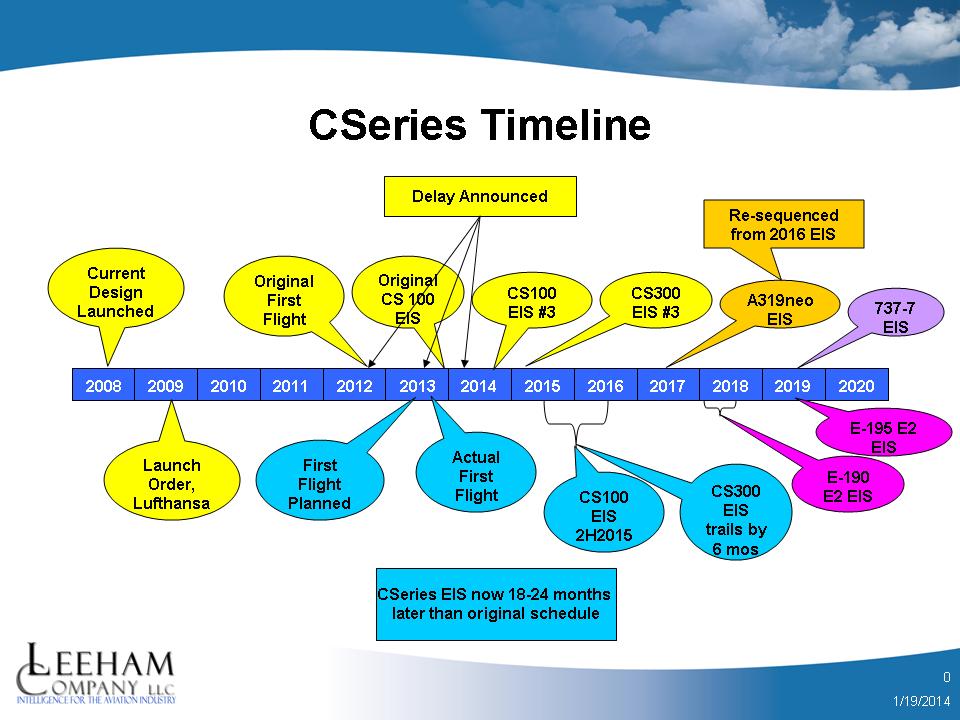

CSeries timeline: Bombardier last week announced a third delay in the CSeries program, this time for as much as a year.

This probably should have been expected. BBD originally planned a five year period between program launch and entry-into-service. As we saw with the Boeing 787, launched with a four year timeline, even five years was too ambitious.

The EIS period for the 787 turned out to be the standard seven years, almost eight–and even then, the EIS was anything but smooth.

Airbus’ launch-to-EIS for the final A350 version is somewhat more than eight years. Even though BBD is a sub-contractor on the 787 program and said it benefited from lessons learned, it’s clear officials were far too ambitious.

KC-46A roll-out: Boeing’s first tanker for the USAF based on the 767-200ER will roll out this summer. The Everett Herald has this story. The airplane is a somewhat revised 767-200ER called the 767-2C. In addition to upgrades with the airframe, the Pratt & Whitney PW4000 engines will have upgrades which improve fuel consumption.

China’s new airplane: China isn’t just developing the ARJ21, C919 and some military airplanes. It’s also developing the world’s largest amphibian.

Posted on January 20, 2014 by Scott Hamilton

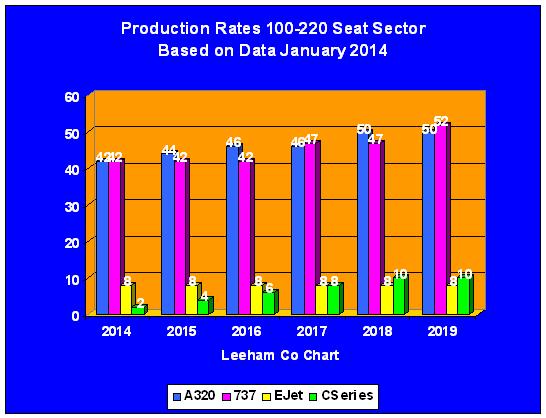

Boeing notified supply chain: prepare for 52 737s per month

In a letter dated January 3, Kent Fisher, vice president of supplier management, set the date for going to 47/mo in July 2017. The year had previously been announced by Boeing. Fisher continued that demand is “sufficient” to take the “protection rate” to 52/mo “later in the decade.”

“Protection rate” means the Boeing and the suppliers need to protect the ability to increase to the desired rate in terms of tooling, machinery, parts, and their own suppliers. This notification isn’t as firm as announcing an actual production rate increase, but it’s pretty close.

Airbus, meanwhile, continues with construction of its Mobile (AL) plant, with a target operational date of next year. Initial production will be 2/mo, ramping up to 4/mo. The plant has the capacity of 8/mo. This means Airbus increases production of the A320 family to 44 in late 2015 or early 2016, then 46 later in 2016 and 48 to 50 thereafter.

The Airbus and Boeing production rates dwarf those of Bombardier, which is challenging the Big Two OEMs at the lower end of the 100-220 seat sector with the 110-145 seat CSeries, and Embraer, which produces the 100-122 seat E-190/195 E1 today and which is offering the 132 seat E-195 E2 for delivery beginning in 2018.

Airbus’ factories are in Hamburg, Toulouse, Tianjin and from next year, Mobile. Hamburg and Toulouse are currently producing 38 A320 family members a month, weighted toward the latter, and Tianjin is at 4/mo. Tianjin and Mobile have the capacity of 8/mo each; we don’t know the total capacity of the Hamburg and Toulouse plants but are told these are at capacity; Airbus declined comment. This means Airbus has the capacity to go to 54 A320s/mo among the four plants after Mobile is fully operational.

Boeing has the capacity for 63 737s a month at its single Renton (WA) factory. Embraer has the capacity for 17 E-Jets a month. Bombardier plans a capacity of 20/mo for the CSeries.

Posted on January 19, 2014 by Scott Hamilton

Embraer continues and refines its strategy at the low-end of 100-149 seat sector

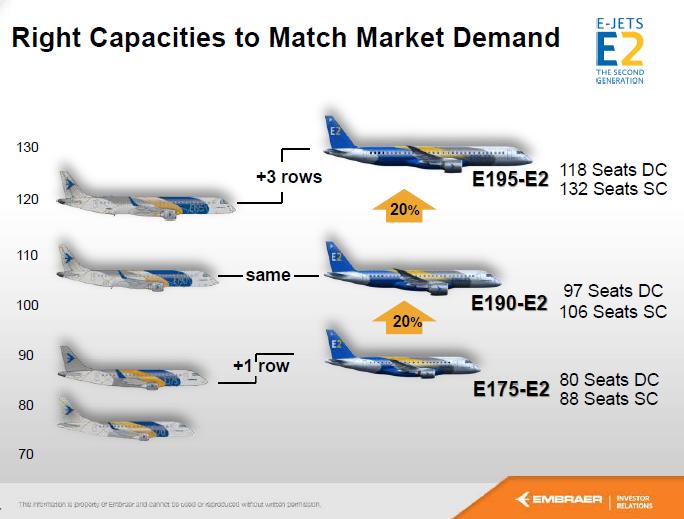

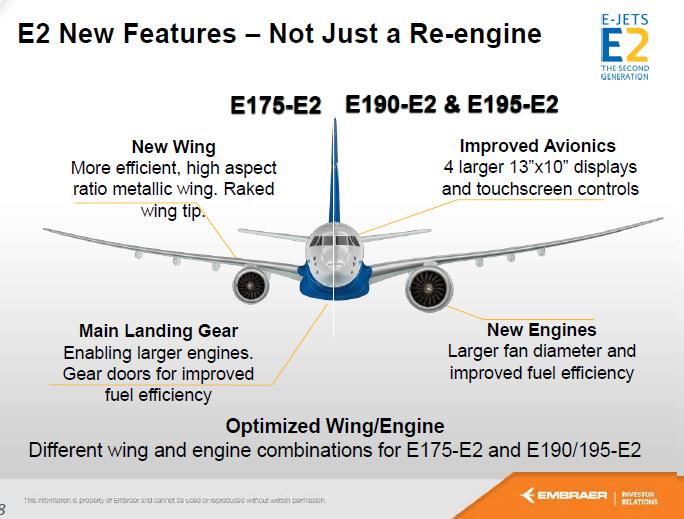

While Airbus and Boeing slug it out in the competition for the duopoly and Bombardier struggles to gain respect as an emerging mainline jetliner producer, Embraer continues and refines its strategy in the smaller-end of the jet market with its E-Jets, E-Jet “Plus” (our term) and the E-Jet E-2.

Embraer is broadening its offering from a maximum of 122 seats to a maximum of 132 and dropping its low-end E-170 from future variants. This brings the EMB family to 90-132 seats, following the decision to undertake an extreme makeover of the current E-175/190/195 line by adapting the Pratt & Whitney P1000 Geared Turbo Fan engine to a new wing design and upgrading a variety of systems in the E-Jet E2.

Source: Embraer. Reprinted with permission.

Posted on January 13, 2014 by Scott Hamilton

Airbus, Boeing, Bombardier, CSeries, Embraer, Leeham Co., Pratt & Whitney

737-7, 737-700, A319ceo, A319neo, A320, Airbus, Boeing, Bombardier, CRJ, CRJ-1000, CRJ-700, CRJ-900, CS-100, CS-300, CSeries, E-175, E-175-E2, E-190, E-190 E2, E-195, E-195 E2, E-Jet E1, E-Jet E2. ERJ, Embraer, Geared Turbo Fan, GTF, Pratt & Whitney, Pure Power

Looking ahead to 2014

Here’s what to look for in 2014 in commercial aviation.

Airbus

A350 XWB: The high-profile A350 XWB program continues flight testing this year. Entry-into-service has been a sliding target. The program is running about 18 months behind original plan and EIS was intended for mid-year following initial delays. Even this has slipped, first to September and then to “the fourth quarter.” Currently first delivery is scheduled in October to launch customer Qatar Airways, which is slated to get four A350-900s this year. Emirates Airlines is listed as getting two of the total of six scheduled for delivery.

A320neo: Lost in the shadow of the A350 program is the A320neo. Final assembly of the first aircraft is to begin in the spring and first flight, followed by testing, is scheduled for this fall. The Pratt & Whitney Geared Turbo Fan is the initial variant. First delivery is scheduled in the fall of 2015.

Others: Airbus continues to evaluate whether to proceed with developing an A330neo. Based on our Market Intelligence, we expect a decision to proceed will come this year. Concurrently with this, we expect most if not all of the remaining 61 orders for the A350-800 to be upgraded to the A350-900 and the -800 program to be officially rescheduled if not dropped. The -800 is currently supposed to enter service in 2016, followed by the A350-1000 in 2017. But recall that as delays mounted on the A350-900, Airbus shifted engineers to the -900 and the -1000 at the expense of the -800. Salesmen have consistently shifted orders from the -800 to the larger models. We long ago anticipated the -800’s EIS would be rescheduled to 2018, following the -1000. The -800’s economics aren’t compelling enough just justify the expensive list price. So we expect Airbus to upgrade the A330 to a new engine option, using either or both of the Trent 1000 TEN and GEnx with PIPs (Performance Improvement Packages) or with some modifications. EIS would be about 2018. This precludes Pratt & Whitney from offering a large version of the Geared Turbo Fan, which wouldn’t be ready by then.

We also expect Airbus and the engine makers to look at re-engining the A380, driven by desires of Emirates Airlines to see a 10% economic improvement. Emirates announced an order for 50 A380s at the Dubai Air Show but instead of ordering the incumbent engine from Engine Alliance for these, Emirates left the engine choice open. This leaves open the possibility the A330neo and the “A380RE” could share an engine choice.

Boeing

After many years of turmoil, 2014 should be quiet for Boeing (now that the IAM issues have been resolved—see below).

787: Barring any untoward and unexpected issues, Boeing seems at long last to be on an upward trajectory with this program—but we’ve said this before. There are still nagging dispatch and fleet reliability issues on the 787-8 fleet to resolve, but flight testing of the 787-9 appears to be going well. Certification and first delivery should come without trouble this year, to launch customer Air New Zealand.

737: Nothing to report on the Next Generation program except ramp-up to a production rate of 42/mo is to take effect this year. Development continues on the 737 MAX.

Others: The 777 Classic is humming along. Now that the 777X is launched, we’ll be closely watching sales for the Classic; Boeing has a three year backlog but six years to 777X’s EIS. How is Boeing going to fill this gap, and what kind of price cuts will be offered to do so?

The 747-8 continues to struggle, barely holding on. Boeing says it thinks the cargo market will recover this year, boosting sales of the 747-8F. We’re dubious.

The 767 commercial program continues to wind down. The 767-based KC-46A program ramps up.

Posted on January 12, 2014 by Scott Hamilton

air force tanker, Airbus, Boeing, Bombardier, Comac, CSeries, Embraer, GE Aviation, Irkut, Mitsubishi, Pratt & Whitney, Rolls-Royce, Sukhoi, YAK

737 MAX, 747-8, 757, 767, 777 Classic, 777X, 787, A320NEO, A330, A330neo, A350, A380, A380RE, Airbus, ARJ21, Boeing, Bombardier, C919, CSeries, E-Jet, E-Jet E1, EJet E2, Embraer, GE Aviation, GEnx, Irkut, KC-46A, MC-21, Mitsubishi, Mitsubishi MRJ, Q400, Rolls-Royce, SSJ100, Sukhoi, Superjet, Trent 1000-TEN, YAK, Yak-242

Outsourcing focus of Boeing report, but misses bigger picture; IAM vote aftermath; Boeing’s 2013

A long article (10 pages when printed) discusses the pitfalls Boeing had by outsourcing so much work on the 787. This much is not new. The point the article raises–transferring technology and the potential decline of US aerospace dominance–isn’t especially new, either; we’ve written about this in the past.

What the article, however, overlooks is that Boeing isn’t alone in doing this. To certain degrees, Airbus, Bombardier and Embraer also are guilty–as are a number of other OEMs and suppliers. CFM International, for example entered into a joint venture with the Chinese that would help them develop an modern commercial jet engine. Fortunately, CFM pulled back on this over concerns of technology transfer.

Airbus has an A320 assembly line in Tianjin, China, and Embraer had an ERJ-145 assembly line in the PRC. McDonnell Douglas had an MD-80/MD-90 line in Shanghai.

Bombardier contracts with Chinese companies to produce the Q400 and CSeries fuselages, the latter with the advanced aluminum-lithium metals.

The airframe OEMs will tell you that final assembly represents a small portion of the airplane and the risk of technology transfer is minimal. But it’s probably no coincidence that the COMAC/AVIC ARJ21 looks the the MD-80 (but sized like the DC-9-10) or that the C919 looks an awfully lot like the A320.

The article points out that Mitsubishi, which builds the wings for the Boeing 787, is now using this experience to design and build the MRJ-90. True enough, though it should be noted that having experience the composite wing issues associated with the 787, Mitsubishi abandoned plans for a composite wing for the MRJ and is proceeding with metal instead.

Suppliers are basically extorted by China: if you want to sell us your goods, you have to be prepared to transfer technology. Suppliers can’t ignore this huge market, but try to mitigate the blackmail by transferring “yesterday’s” technology or at least developing tomorrow’s technology today while transferring today’s technology to China.

It doesn’t stop with China, of course. Boeing and Airbus have Russian ties with engineers. Bombardier is planning a Q400 assembly line in Russia. Indian engineers work on Airbus and Boeing airplanes and now plan their own turbo-prop.

The days of the Big Two Duopoly are numbered. And it’s not just Boeing that is guilty of aiding and abetting the new competition.

Boeing’s Good Year in 2013

Set aside the disruptive and embarrassing ground of the 787 in January through April, Boeing had a very good year in 2013. It posted a record rate of deliveries, besting Airbus for the second year in a row. It’s order book was the best since 9/11. Here is the press release.

Airbus announces its 2013 production and delivery results on January 13.

Boeing-IAM vote: After-thoughts

We can’t go by this week without a short commentary on the Boeing-IAM vote on Friday, but we’re not going to spend a lot of time on this—we’ve analyzed this issue a number of times and there is little more to say except this:

It was a very tough vote for the union members of IAM 751. Giving up benefits won in previous hard-fought battles is always tough. But the Boeing 777X will be assembled in Washington State, and the composite wings will be built in Washington, too. Our view is that having 80% of something (benefits) is better than 100% of nothing (the 777X).

Boeing, of course, will return to the State and the union for more tax breaks and concessions when the 757 and 737 replacements are designed and a decision is needed about where to build these airplanes. Boeing is now in a position to seem more concessions from labor during a contract that’s in place to September 2024, and the union can’t strike. It’s been significantly weakened, losing leverage ion addition to benefits as a result of Friday’s contract vote.

But this enables Boeing to tell customers the threat of delivery disruptions from strikes is gone, and this will reassure them, which may or may not help sales—thus providing more work for IAM members.

Boeing faces a huge morale problem for the members who feel they’ve been had in this process. IAM members have long, long memories. Although there is no option to strike, members can “work to the rules” or find other ways to decrease productivity. Boeing has some real fence-mending to do. We’ll see whether it makes any effort to do so.

Labor isn’t content with the narrow yes vote, however. Some are calling for a third vote, arguing the January 3 election date was set to deliberately disenfranchise a large number of union members who likely would have voted No. Turnout last week was lower than the November 13 vote because many members were still on vacation from the Christmas and New Year’s holidays.

Posted on January 6, 2014 by Scott Hamilton

Airbus, Boeing, Bombardier, CFM, China, Comac, CSeries, Embraer, IAM 751, International Association of Machinists, McDonnell Douglas

787, Airbus, ARJ-21, AVIC, Boeing, Bombardier, C919, CFM International, Comac, CSeries, Embraer, ERJ-145, IAM 751, International Association of Machinists, McDonnell Douglas, MD-80, Q400

Qatar swaps A319neo to A320neo; just 29-39 orders remain

Qatar Airways has swapped its order for the A319neo in favor of the A320neo, leaving just 29-39 orders remaining for the smallest version of the neo family.

Qatar became the first customer for the A319neo when it placed a surprise order at the 2009 Paris Air Show. Bombardier had negotiated a contract for 20 CSeries to be signed at the show, and with market expectations high, was embarrassed when Qatar’s CEO, Akbar Al-Baker, did one of his famous U-Turns and didn’t proceed. (Al-Baker would embarrass Boeing and Airbus at later air shows by withdrawing an announced deal for the 777-300ER and no-showing at an Airbus press conference.) We were reliably told that the French government intervened with the Qatari government to block the important CSeries order at the Paris Air Show in favor of an order for the A319neo and A320neo.

Avianca Colombia retains an order for nine and Frontier Airlines has 20, according to the Ascend data base. Flight Global reports Avianca has 19 on order, however, and this is the figure shown in an Avianca presentation, probably reflecting options yet to be exercised. Avianca is scheduled to get three in 2017, two in 2018 and the rest in 2019, according to Ascend. Frontier is scheduled to begin taking delivery in December 2018 through 2020.

This means the A319neo, which was supposed to enter service in 2016, six months after the October 2015 EIS for the A320neo, now slips behind the A321neo EIS.

The new EIS schedule means the A319neo still is planned to enter service two years before Boeing’s 737-7 MAX but two years after Bombardier’s CS300. Embraer’s E-195 E2, which seats 133 in single class to the A319neo’s 156 in single class, is scheduled to enter service in 2019.

The Frontier order is iffy, we believe. The CEO, David Siegel, told us a couple of years ago economics of the A319 aren’t very good in today’s fuel environment and favored the larger A320. Frontier was then owned by Republic Airways Holdings and was sold this year to Indigo, an investment group (not related to India’s Indigo Airlines). Indigo was principal owner of Spirit Airlines, an ultra-low cost carrier in the US. Siegel has been transforming Frontier from a low cost carrier to a ULCC. The new ownership is certain to accelerate this transition.

We expect the new ownership will also favor the A320neo and A321neo, and that eventually the order for the A319neo will be up-sized. We believe Avianca will inevitably follow.

This means Airbus will probably drop the A319neo eventually. The A319ceo may be retained through 2019 at steeply discounted prices, but more likely the A320ceo with deep discounts will be Airbus’ continuing competitive response to Bombardier’s CS300 and, to a lesser extent, Embraer’s E-195 E2.

Boeing has sold the 737-7 only to Southwest Airlines and WestJet. Southwest is said to need the 737-7 for its Midway Airport operations. Air Canada has the option to convert some of its 737 MAX orders to the -7.

Posted on December 31, 2013 by Scott Hamilton

Vote for the Top Commercial Aviation stories of 2013

This is self-explanatory. We’ll publish the results December 31.

Feel free to nominate other stories in Reader Comments.

Posted on December 23, 2013 by Scott Hamilton

Airbus, Airlines, American Airlines, Boeing, Bombardier, CSeries, Embraer, IAM 751, International Association of Machinists, US Airways

777X, 777X site selection, 787, 787 grounding, 787-10, A350 XWB, A380, Airbus, Boeing, Bombardier, CSeries, E-Jet E2, Embraer, IAM 751, International Association of Machiniists

Odds and Ends: EMB, BBD split AA order; WTO on Airbus subsidies; IAM, Boeing bargaining; KC-46A

EMB, BBD split American order: Embraer took the lion’s share of the long-awaited order from American Airlines for regional jets. EMB won 60 firm orders and 90 options for the E-175 and Bombardier won 30+40 CRJ-900s. Flight Global points out that none seem to be going to American Eagle.

The order is welcome by both OEMs, which had gaps in their respective production lines.

WTO on Airbus subsidies: Bloomberg News reports that the World Trade Organization won’t rule until the end of next year on a US complaint that Airbus failed to comply with WTO findings that it received illegal subsidies. (No link available).

Bloomberg writes, The EU says it had secured repayment of some $2.3 billion in launch-aid loans and terminated the launch-aid loan agreements in question, while also addressing subsidies given in the form of capital contributions, infrastructure support and regional aid.(Emphasis added.)

The U.S. counters that the largest launch-aid subsidies—for the A380, Airbus’s super jumbo jet—remain in place and that the actions the EU claims to have taken with respect to earlier subsidies “appear to do nothing to withdraw them, or to remove their adverse effects.”

As we’ve written, Boeing is now requesting essentially the same thing in its Request for Proposals for the 777X site selection.

IAM, Boeing bargaining: It’s a relief to see Boeing and the International Association of Machinists District 751 bargaining for a new contract amendment for the 777X site selection, but no deal is imminent. The Seattle Times reports things could move quickly, however.

First KC-46A airframe, wings joined: Aviation Week has this story about the progress of Boeing’s KC-46A tanker program.

Posted on December 12, 2013 by Scott Hamilton

Assessing the Air Canada 737 order: factors that likely played a role

How did Boeing win the Air Canada mainline 150-200 seat jet order when only a couple of weeks ago Flight Global reported the Airbus won the deal?

We, too, heard that Airbus seemed to be the favorite, but the information was soft. We’re not rapping Flight Global—undoubtedly it was confident in its sourcing, but this just shows that a situation can change dramatically and quickly.

We’ve been following the competition for months, behind the scenes, and here are factors we understood that were involved.

Posted on December 11, 2013 by Scott Hamilton

Air Canada snubs Airbus, orders 737s; keeps some of Embraer portion open

Air Canada snubbed Airbus with its mainline jet fleet renewal and ordered up to 109 Boeing 737 MAXes. The initial order is for the 8 and 8 MAX, with the ability to swap for the 7 MAX. The deal includes the provision for Boeing to purchase up to 20 Embraer E-190s, which would be replaced by the 7 MAX, apparently.

But Air Canada is keeping open the prospect of replacing the other 25 E-190s with a new jet or to keep operating them. Bombardier hopes to win this segment of the order.

This is a big win for Boeing and one of the rare times Boeing has displaced Airbus in the MAX v NEO competition of an incumbent Airbus operator.

The Air Canada press release is below the jump.

Posted on December 11, 2013 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008