Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Odds and Ends: Air France/KLM trims cargo fleet; ExIm Bank countdown; BBD v EMB; More

Air France-KLM trims cargo fleet: Steve Wilhelm of The Puget Sound Business Journal reports that Air France-KLM group is sharply trimming its cargo fleet, with the company declaring the capacity continues to shift to the belly capacity of passenger airplanes. This further validates what we have been writing for some time and, in our view, further bolsters our argument that the demand for new-build, dedicated freighters continues to fall. This in turn means Airbus won’t see recovery for the A330-200F nor will Boeing see recovery in demand for the 747-8F or 777-200LRF.

ExIm Bank Countdown: September 30 is the date the US ExIm Bank runs out of money. Although there is talk of a short-term extension of a few months (conveniently taking it past the election and perhaps defusing some of the Tea Party angst over the agency), Emirates Airlines said it will still buy Boeing airplanes even if ExIm isn’t renewed.

This can’t help Boeing’s argument that ExIm should be retained.

Left unsaid in Emirates’ statement, however, is something we heard in the market: Boeing’s deal for the 150 777Xs with Emirates nearly fell apart over the ambiguity over the Bank. We’re also told Boeing agreed to backstop the Emirates deal.

Neither Boeing nor Emirates comment on financing support.

Bombardier vs Embraer: Here is an interesting thought piece on the financial returns of Bombardier vs Embraer. One obvious error in the article: Malmo Aviation didn’t cancel its order for the CS100; it just decided not to be the launch operator.

Neither do you: Flight Global writes this about the end of plans between COMAC and Bombardier to have a common cockpit between the C919 and the CSeries:

“Basically in the development of the C919, Bombardier is not involved,” says [CAAC}. “They have experience in building regional jets, but not so much in narrowbodies.”

We can’t help but think the Chinese learned what they wanted to learn and moved on.

787 safety: This is one of those stories for which we have skepticism but which is already getting enough press that we don’t feel we can ignore it. Al Jazeera America has a special Wednesday night about the safety of the Boeing 787. AJM previously did an investigation of the safety of the Boeing 737. The Seattle Times has an early review. We’ll hold our opinion until after watching the program.

Ryanair finally orders 737 MAX: Once Boeing announced the launch of the 200-seat 737-8 MAX at the Farnborough Air Show, an order from Ireland’s Ryanair was only a matter of time. It became official today: Ryanair ordered 100+100 of the new version, the 737 MAX 200.

Posted on September 8, 2014 by Scott Hamilton

BBD faces skyline challenges in 2016: Russia, Ukraine, Iraq customers

Note: The CSeries resumed airborne flight tests Sept. 7.

The announcement two weeks ago by Sweden’s Malmo Aviation that it won’t be the first operator of Bombardier’s CSeries is an unneeded image hit for the program, but not one we’re particularly concerned about. We think there are other early operators who potentially raise more concern.

Malmo was scheduled to receive its first CS100 in the second half of next year. The program’s entry-into-service will possibly slip into 1Q2016 as a result of the May 29 engine failure with a Pratt & Whitney P1000G on CS100 Flight Test Vehicle 1. Engines are being redelivered and we expect the first of the FTVs to return to the air very soon.

Posted on September 7, 2014 by Scott Hamilton

Airlines, not passengers, at fault for recline wars

A third incident of “recline wars” has been reported, this time on a Delta Air Lines flight in which a dispute broke out between a passenger who reclined his seat and the passenger behind him who didn’t like it.

The New York Times has an article on the entire issue.

While the focus and debate has, so far, centered around who has rights–the passenger to recline or the passenger claiming reclining violates his space–the real issue, and blame, ought to rest with the airlines squeezing down legroom to a seat pitch of 28 inches (in the case of Spirit Airlines and Allegiant Air) to an increasingly common 30 inches on legacy carriers.

Posted on September 2, 2014 by Scott Hamilton

Odds and Ends: Malmo and CSeries; Boeing’s Terrible Teens; MH 370

Malmo and CSeries: Malmo Airlines, a small carrier in Sweden that is a subsidiary of Braathens, last week said it withdrew as the launch operator of the Bombardier CSeries. Malmo has five CS100s and five CS300s on order.

First delivery was scheduled for the second half of next year. The oil line failure in a Pratt & Whitney GTF engine on May 29 has set the flight testing back, although BBD hasn’t said by how much. We believe it will likely be a day-for-day setback and it’s possible that EIS will actually slip to 1Q2016.

The flight test fleet is expected to return to the air this month.

According to the Ascend data base, Lufthansa Group’s Swiss Airlines subsidiary was to be the second operator, also in 2015. We don’t expect Swiss to change its planned delivery schedule.

Posted on September 1, 2014 by Scott Hamilton

After-market support becoming key to winning engine orders

Maintenance and power-by-the-hour parts and support contracts are increasingly becoming the deciding factor in deciding which engines and which airplanes will be ordered—it’s no longer a matter of engine price or even operating costs, customers of Airbus and Boeing tell us.

Ten years ago, 30% of engine selection had power-by-the-hour (PBH) contracts attached to them. Today, 70% are connected, says one lessor that has Airbus and Boeing aircraft in its portfolio, and which has ordered new aircraft from each company.

“We’ve seen a huge move in maintenance contracts,” this lessor says.

Posted on August 25, 2014 by Scott Hamilton

Airbus, American Airlines, Boeing, Bombardier, CFM, Comac, CSeries, Embraer, GE Aviation, Irkut, Mitsubishi, Pratt & Whitney, Rolls-Royce

737 MAX, 737NG, 747-400, 767, 777, 777-200LR, 777-300ER, 777X, 787, A320ceo, A320NEO, A330ceo, A330neo, Airbus, American Airlines, Boeing, Bombardier, C919, CF34, CFM, CFM 56, Comac, CSeries, E-Jet, E-Jet E2, Embraer, Frontier Airlines, GE Aviation, GECAS, GEnx, GTF, Irkut, LEAP, Lufthansa Airlines, MC-21, Mitsubishi, MRJ, Pratt & Whitney, Republic Airways Holdings, Rolls-Royce

PW re-delivering GTF to Bombardier CSeries flight test fleet, airborne program likely next month

Pratt & Whitney has completed a design repair for the Pure Power 1500G used on the Bombardier CSeries Flight Test Vehicles (FTVs) and is re-delivering the engines, Leeham News has learned.

Flight tests are expected to resume in September, likely the first half, according to sources close to the situation. BBD will only say flight tests will resume “in the coming weeks.”

A PW spokesman was equally ambiguous. “We continue to work closely with Bombardier to return the CSeries to flight testing,” the spokesman wrote in an email. “I would also note that the fundamental architecture of the Geared Turbofan engine remains sound.”

The FTVs have been grounded since May 29, when a PW engine on FTV 1 suffered a failure in an oil seal, causing a fire and spewing engine parts into the composite wing of the airplane. The wing is undergoing repairs.

Details of the fix for the FTV engines have not been revealed. But one person familiar with the situation told us that the FTV engine repairs enable the test fleet to return to the air, and that the redesign of the affected area of the engine will be incorporated into a production redesign before the CSeries enters service. Bombardier continues to maintain that the CS100, the first of the two-member family scheduled to enter service, will do so in the second half of 2015. Some aerospace analysts believe BBD will be hard-pressed to meet this schedule, and EIS will slip into early 2016. The larger CS300 was scheduled to enter service six months after the CS100, and it’s unclear if this EIS will continue to have a six month gap.

Bombardier is preparing to resume the flight test program with the four FTVs that have been completed; three more are in assembly.

The Pure Power 1100G for the Airbus A320neo, scheduled to enter service in October next year, will incorporate the production redesign, says the source familiar with the situation. No delay is expected in this program.

Posted on August 25, 2014 by Scott Hamilton

Odds and Ends: CSeries status; Airbus accident analysis; 737 rate increase; Kenya Air holds Boeing hostage

CSeries Status: Here is an interesting, detailed article from a blogger who follows the Bombardier CSeries more closely than anyone we can think of.

The article pretty well summarizes the issues, although we have this additional color: the fixes have been identified and are being installed and are still in Transport Canada review for approval and the green light to resume flight testing.

Airbus accident analysis: Airbus issued a study that looks at the causes of commercial accidents since 1958. The full report may be found here. The report is intentionally light on text and heavy on charts and graphics, so it’s easy to digest.

737 rate increase: Several media reported yesterday that Greg Smith, CFO of The Boeing Co., told an investors day Boeing is likely to decide this year on a production rate increase for the 737 line beyond the 47/mo previously announced to go into effect in 2017. Well, you read it here first–we reported more than a year ago Boeing was looking at a rate increase to 52/mo and even 60/mo. We’ve had in our estimates the 52/mo by 2018, 2019 or 2020, followed by 60 a year or two later.

Kenya Air: no more Boeings: We know some Airbus customers have long tied route authority to buying Airbus airplanes, and China is notorious for holding Airbus and Boeing orders hostage for political reasons. Kenya Airlines now says it won’t buy more Boeing aircraft unless it gets US route authority, according to this article.

Posted on August 15, 2014 by Scott Hamilton

Odds and Ends: Airbus regional A330, IAG orders and Bombardier reviewing options

Airbus A330 regional might get sales after all, Airbus is negotiating a large order with China against local off-sets (assembly or final configuration, the experts are divided) according to Wall Street Journal. We reference Ben Sandilands writeup of the story to avoid the WSJ paywall. As we were told at Farnborough by Airbus the A330 regional is a de-papered A330ceo with an adapted interior. It does not make sense to wait for a neo variant for this aircraft as the fuel costs are a less important factor on sub 5 hour missions. It will be interesting to see if some other market will pick up on this 200 tonne aircraft, to some extent it is back to the roots for the A330-300, it started off as a medium haul complement to the long haul A340-200 and -300 at 206t maximum take-off weight.

IAG has given Airbus a cheer up signal after the bad news around SkyMark. In their second quarter report call IAG CEO Willie Walsh declare their A380 as “fantastic aircraft when you can fill it”, they see 98% load factors on their most popular routes (e.g. LHR-LAX). IAG also announced better results in their Spanish daughter Iberia, consequently it is allowed to order 8 A330-200 (ceos as the neo comes to late) and convert 8 of IAGs A350-900 options to firm orders for their airline. Right now IAG is satisfied with the 12 A380 they have on order for BA according to Walsh.

Bombardier is re-examining its options for the recently created Aerospace divisions according to FlightGlobal; they want to leverage the Aerostructures divisions capabilities more when Boeing and Airbus looks for further partners for their booming supply chains. They also need to guard their bets on Russia as partner to drive sales of Q400 and Cseries, given the mounting political problems between Russia and the west. This results in renewed activity in the China / Comac discussions, initially for cooperation on the after sales side in addition to the present fuselage deliveries, but come a worsened situation with Russia such talks could find new depth we think.

Posted on August 1, 2014 by Bjorn Fehrm

Airbus, Bombardier, CSeries, Uncategorized

A330, A330neo, A350, A380, Airbus, Bombardier, Comac, CSeries

Bombardier woes go beyond CSeries

The news last week that Bombardier reorganized its business units, laid off another 1,800 employees and saw the retirement of Guy Hachey, president and CEO of the aerospace division, was viewed by some media and observers as an indictment of the CSeries program. While it’s certainly true that delays in the program weigh heavily on BBD, the problems don’t stop with CSeries.

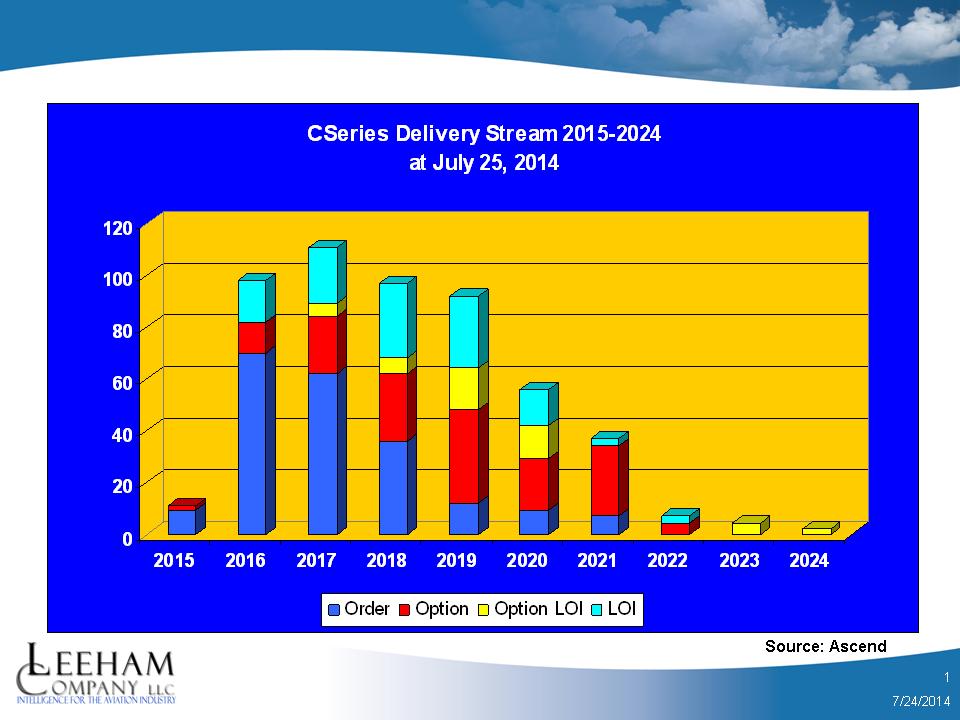

Bombardier has 203 firm orders and 310 commitments for CSeries. This delivery stream doesn’t include any potential rescheduling as a result of the grounding of the Flight Test fleet from May as a result of the engine incident.

Slow sales of the CRJ, Q400 and business jets–as well as program development issues with a new corporate jet–all combined to drag down financial performance and bleed cash. Bombardier doesn’t have the balance sheet strength of Boeing or Airbus, nor strong sales of other airplane family members, to weather the challenges of new airplane development programs.

Posted on July 28, 2014 by Scott Hamilton

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

GE analysis post Farnborough

Our wrap up of Farnborough would be incomplete without looking closer at the world’s leading engine supplier, GE Aviation, which together with partners (like SAFRAN in CFM joint venture) garnered more than $36 Billion in orders and commitments during the show. This figure was only significantly bettered by Airbus ($75 Billion) and it came close to Boeing’s $40 Billion. With such level of business the claim by GE Aviation CEO, David Joyce, that the Airbus A330neo engine business was not the right thing for GE as they have more business than then they know what to do with, was certainly no case of “sour grapes”. Read more

68 Comments

Posted on July 28, 2014 by Bjorn Fehrm

Airbus, Airlines, Boeing, Bombardier, CFM, Comac, CSeries, Embraer, Farnborough Air Show, GE Aviation, Leeham News and Comment, Pratt & Whitney, Rolls-Royce, Uncategorized

737 MAX, 777, 777-300ER, 777X, 787, A320NEO, A330neo, Airbus, Boeing, Bombardier, CFM, Embraer, Pratt & Whitney, Rolls-Royce