Leeham News and Analysis

There's more to real news than a news release.

737 MAX may share NG improvements still to come, which might include more seats

Boeing’s 737 MAX, still weeks away from design configuration freeze and still with lots of detailed design to come, may share improvements still to come on the current 737 NG.

The head of the MAX program, Keith Leverkuhn, vice president and general manager, wouldn’t confirm or deny a report by Aspire Aviation that the MAX family will have 6-9 more seats through interior changes, the use of slim line seats and door changes when asked during Boeing’s MAX briefing yesterday with an international crowd of journalists.

Citing unidentified Boeing sources, Aspire reported:

- Boeing to modify 737 MAX 8 doors to add around 9 seats;

- 737 MAX 8 to meet 13% fuel burn reduction per seat target after door modification;

- Door modification has negligible impact on MEW; and

- 737 MAX 7 & MAX 9 also likely to have around 9 more seats.

Leverkuhn told the media that Boeing was satisfied with the current configuration of the airframe of the NG and MAX shares this configuration. Although Leverkuhn said Boeing had no intentions of changing, it still would talk with customers–leading to the obvious conclusion that Boeing wasn’t saying a firm “no” to the possibility.

We talked with him a few minutes alone later in which he clarified his earlier comments. Leverkuhn told us that while there will be no changes to the doors on the MAX which would allow more seats, the NG program is considering interior configurations that could lead to more seats and the MAX and NG programs closely follow developments and determine what can be shared between NG improvements still to come and the final MAX design.

Airbus in January announced a space-flex program that includes two new doors, enabling high density capacity to grow to 236 from 220. Airbus previously began offering a revised aft galley/lav combination in the A320 to permit three more seats, to 153 in two-classes. Boeing has been studying similar changes, according to our market intelligence.

Sizing up engine market share on the A320 family

While competition between Airbus and Boeing snares nearly all the headlines and all the “sex,” competition for engine orders is less sexy and receives less attention.

Part of this is because of the increasing trend toward sole-sourcing. The Boeing 737 has been sole-sourced by CFM International since the creation of what is now called the Classic series: the 737-300/400/500. Pratt & Whitney believed at the time Boeing was upgrading the 737-200 that airplanes were up-gauging and bet its future on the Boeing 757 size. It was one of the classic corporate blunders of all time.

Shut out of the 737, P&W joined with Rolls-Royce and MTU to build the International Aero Engine V2500 for the Airbus A320 family. IAE came to the table late, giving CFM a solid head start on the program with a variant of the CFM 56 that powers the 737 Classic and later the 737 NG.

IAE trails to this day, but has done a remarkable job of coming from behind. CFM tends to be favored on the A319 and A320 while IAE is the preferred engine on the larger A321. IAE offers more thrust and better economics on the A321 while the CFM has better economics for the smaller Airbuses. CFM’s reliability is legendary and tends to be better than the V2500.

The blog PDXlight has done a marvelous job of dissecting the engine market share of the A320 family for the New Engine Option. We asked PDXlight to do the same exclusively for us for the A320ceo family. The results are below the jump.

Odds and Ends: Boeing stock buyback; Charging suppliers for doing business; AA+US

Boeing Stock Buyback: Boeing announced a stock buyback of #3.6bn for next year. Wells Fargo has this to say in a research note issued today:

Boeing had more than $11B of cash on the balance sheet at the end of September, and after free cash flow of $5.7B in 2013 and more than $7B in 2014 (i.e., almost $10/share in free cash), we believe Boeing could have over $20B in cash available to return to shareholders over the next few years. This is why we see about a $130MM increase in dividends and a $1.5-2.0B buyback in 2013 as small steps in returning cash to shareholders.

We’re not a fan of buybacks, which serve to prop up stock prices. We believe stock should rise on its own merits, not because of some artificial prop-up. More to the point, however, is that Boeing has a hard time telling SPEEA it needs to cut costs when it is spending billions on buybacks that benefit (among others) Boeing’s largest shareholders–the McDonnell family, Harry Stonecipher and Jim McNerney.

SPEEA is preparing for a strike February 1. Talks resume January 9, but the gulf between the two sides is so great, SPEEA expects them to break down almost immediately.

With Wells Fargo estimating that Boeing might return $20bn to shareholders in the next few years, we somehow think this will be an issue when IAM contract negotiations come up in 2016 and Boeing pleads poverty again (as it inevitably will).

We’d much rather see the money invested in new airplane programs rather than derivatives like the 737 MAX and 777X.

Boeing charges royalties to suppliers: Mary Kirby has this interesting story about Boeing charging suppliers for the price of doing business with the company.

American and US Airways: The Ft. Worth Star-Telegram has this column discussing the case for a merger between American Airlines and US Airways.

Pegasus Buys Airbus: Turkey’s Pegasus Airlines ordered 75 A320neo family and optioned 25 more. The carrier was previously a Boeing 737 operator. Deliveries are from 2015, which means the Pratt & Whitney GTF has to be the engine choice, which is as yet unannounced. CFM’s LEAP-1A won’t be ready until later in 2016.

Before this order, Airbus had a 61% market share of the re-engine order race vs the 737 MAX (firm orders only).

Photo Montage: The Everett Herald has this photo montage of the Flying Heritage Museum’s aircraft. The Museum is owned by Microsoft co-founder Paul Allen.

Freighter Market Softens: Cargo Facts has this analysis of the freighter market.

Odds and Ends: SPEEA says strike is likely; CFM LEAP update

SPEEA v Boeing: The Seattle Times reported that there is a very high chance of a strike by SPEEA against Boeing come February. This is, of course, bad news for all concerned.

SPEEA is already talking about a 60 day strike and says this would cost Boeing $400m a day. In 2000, when SPEEA struck for 60 days, Boeing deivered 50 fewer aircraft for the year. IAM 751’s 57 day strike in 2009 depressed sales and cost Boeing billions (though nothing like the $400m SPEEA forecasts, which is a puzzle).

Customers, who were ticked off by the IAM strike, will once again be the innocent bystanders in this potential strike. A strike will also redouble Boeing’s drive to diversify to non-union states, though hopefully this time it won’t be so stupid as to connect the dots again as it did with the 751. It’s our belief Boeing can’t fulfill the demand for engineers in Washington State anyway so it has to locate work elsewhere. Although as a Washington State resident we don’t want to see this happen, this is, we believe, reality.

SPEEA has the power to truly disrupt things at Boeing, not only for deliveries but also for future engineering projects, but nobody will win and everybody will lose if Boeing and SPEEA don’t reach an agreement.

CFM LEAP Update: The Seattle Times also has this update on the CFM LEAP-1B, the version for the Boeing 737 MAX.

Noteworthy in the article is the revelation of the contractual commitment for CFM to reduce fuel burn for the LEAP-1B by 15% compared with today’s 737 CFM engine. This is a key piece of information and well beyond the Airbus assumption in the continuing war of words between the two companies.

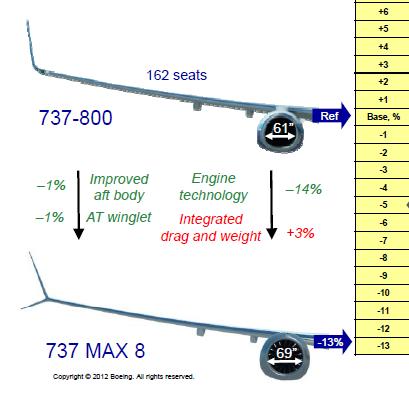

It also is key to Boeing’s previously advertised target of the 737 MAX being 13% better than today’s 737NG. What strikes us, however, is whether 13% is still an operative figure.

All other things being equal, installation typically costs 1%-2%, which means the MAX on engine installation alone should be 13%-14% better than the NG. We know that Boeing is working hard on airframe improvements. Shouldn’t the 13% actually be better? We know the advanced winglets are supposed to add 1.5% to fuel reduction, for example. Boeing has also cleaned up the tailcone and undertaken other aerodynamic improvements.

We’ve asked Boeing and will post its response when received.

Update, 2pm PST: We have an answer of sorts from Boeing, though we’ve asked for further clarification.

“CFM’s number is in SFC or specific fuel consumption for a given thrust which when you apply it to a specific mission gives you the fuel-burn reduction for that trip. The attached shows a 500-nmi trip comparison which gives the MAX engine 14% fuel-burn reduction compared to the NG engine, next we factor in engine integration and aero improvements ending up with a total 13% reduction for a 500-nmi trip compared to the NG).

“You will see in the chart that we credit the AT winglet with approximately 1 percent improvement (again this is at a 500-nmi trip). However, at longer ranges customers will experience even more improvement from the AT winglets, up to 1.5%.”

This chart (click to enlarge) is extracted from Boeing’s Farnborough presentation. It starts with a 14% improvement for the engine, while the news article says 15% is required in the CFM contract. The Boeing spokesperson said this is for a 500nm mission at a “specific thrust” level. We’re trying to clarify the difference between the 15% contract number and the 14% above. If we get this clarity, we’ll update again.

Update, 545pm PST: Here’s the final answer from Boeing:

“CFM’s number is in pure SFC and our numbers are in fuel-burn per trip so they are not equivalent. It’s like comparing apples to oranges. In our case – we are using a 500-nmi trip which is our standard comparison. This includes then in our calculations the fuel-burn cost of lifting the airplane empty weight off the ground since takeoff is part of the trip. CFM’s number is an engine in a test stand compared to another engine in a test stand so the two comparisons are not equivalent.”

Meanwhile…

Not revealed in the article but we learned that there will be a thrust bump for the LEAP engine. Right now CFM lists on its website the LEAP-1B thrust at a maximum of 28,000 lbs, the same as the current engine. Because of the higher weights for the MAX, runway performance has been assessed as poorer than the NG by customers we’ve talked with. A thrust bump, and airframe improvements, are aimed at fixing this issue, we’re told.

Boeing wants to outsource more work to Mexico; updated MAX v NEO orders

Boeing outsourcing: In an election where outsourcing is a major political campaign issue, The Seattle Times reports Boeing wants to outsource more work to Mexico. Here is Boeing’s letter, via The Times.

MAX v NEO: Here is an excellent set of tables updating the orders between the 737 MAX and the A320 NEO. According to the analysis, Airbus right now has a 63% market share for the airframe. On the NEO, where two engines are offered, CFM has a 41% share vs PW’s 39% share with the remainder undecided.

ISTAT Europe: a tough review by Aeroturbopower, and our thoughts

ISTAT Europe: Aeroturbopower has this recap of last week’s ISTAT Europe conference and he takes a devastating hit at the Boeing presentation. We weren’t at the event this year but we’ve seen plenty of Boeing presentations and agree with Aeroturbopower’s assessment that Boeing takes liberties…something we’ve written about and something we’ve also expressed to Boeing directly. Comparing apples to oranges seems to be a common tactic.

But in fairness, Airbus also selectively chooses numbers that boost its case. We dissected one such instance in this column on AirInsight. Both companies play around with the seating configuration of their airplanes and the opposition to come up with numbers for seat-mile costs. We’ve seen Boeing compare ranges of the 737 NG and MAX vs the A320ceo/neo families by including the auxiliary fuel tank for the 737 but not for the A320, completely distorting the comparisons. Boeing relies on DOT Form 41 data and a study from 2006-2009 in Europe when comparing maintenance costs of the two families to argue the 737 costs up to 27% less to maintain. The figure, on its face, defies logic. If the A320 cost this much more to maintain, airlines would be hard-pressed to buy it. But more to the point, the methodology for the DOT Form 41 data is thoroughly discredited as a reliable source of information. Relying on a study that uses data up to six years old is also questionable.

All these manipulations of data is why we view numbers from both companies with a high degree of skepticism. In this column, we discuss this at the very end.

Manipulation of data like this harms the credibility of both companies.

As for Aeroturbopower’s report on the 737 MAX design not being frozen, this is true and it’s not news. Boeing said it won’t be until next year and this is what we are also hearing from customers. We’re hearing from a variety of sources that there are still challenges in achieving the advertised 13% fuel burn improvement over today’s 737 NG. We believe Boeing and CFM will get there, but it remains tough. We would not be surprised to see the 69.4 inch fan diameter increase yet again.

WTO Compliance?

The Washington Post reports that the US has complied with the WTO ruling on Boeing illegal subsidies. Boeing didn’t announce whether it has repaid the illegal subsidies, as it pledged to do if it was found guilty of receiving them.