Leeham News and Analysis

There's more to real news than a news release.

Leeham News and Analysis

Leeham News and Analysis

- The Boeing 767 Cross Section, Part 1 November 24, 2022

- Movie Review: Devotion November 21, 2022

- China will accelerate development of its commercial aerospace sector November 21, 2022

- Bjorn’s Corner: Sustainable Air Transport. Part 46. eVTOL comparison with helicopter November 18, 2022

- The economics of a 787-9 and A330-900 at eight or nine abreast November 16, 2022

Bombardier woes go beyond CSeries

The news last week that Bombardier reorganized its business units, laid off another 1,800 employees and saw the retirement of Guy Hachey, president and CEO of the aerospace division, was viewed by some media and observers as an indictment of the CSeries program. While it’s certainly true that delays in the program weigh heavily on BBD, the problems don’t stop with CSeries.

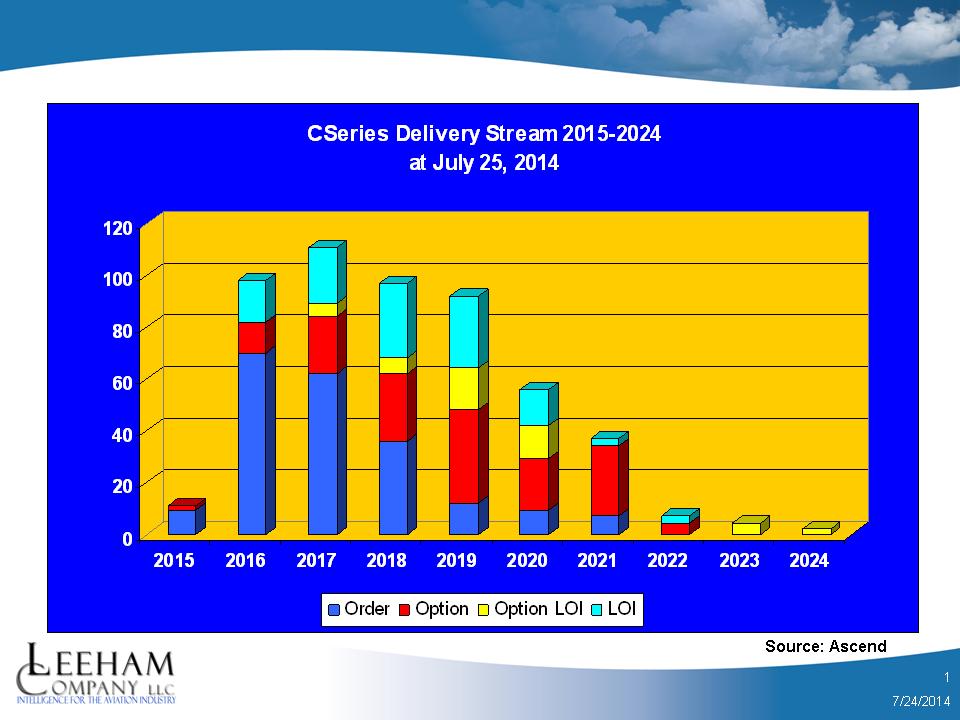

Bombardier has 203 firm orders and 310 commitments for CSeries. This delivery stream doesn’t include any potential rescheduling as a result of the grounding of the Flight Test fleet from May as a result of the engine incident.

Slow sales of the CRJ, Q400 and business jets–as well as program development issues with a new corporate jet–all combined to drag down financial performance and bleed cash. Bombardier doesn’t have the balance sheet strength of Boeing or Airbus, nor strong sales of other airplane family members, to weather the challenges of new airplane development programs.

Posted on July 28, 2014 by Scott Hamilton

Farnborough Air Show, July 17: Orders summary, reflections of the show

Orders continued to trickle in as the Farnborough Air Show winds down (there could be others not listed here).

- Airbus: Transaero, LOI for 12 A330neos and eight A330ceos; Hong Kong Aviation Capital firms up an order for 40 A320neo and 30 A321neo aircraft, announced at the Paris Air Show last year. Here is the Airbus wrap up press release.

- Boeing: Summarizes its performance at FAS with this press release; 201 orders and commitments.

Items of interest:

- Emirates Airlines says it could order 60-80 A380s if Airbus proceeds with a neo.

Overall reflections:

Posted on July 17, 2014 by Scott Hamilton

Farnborough Air Show, July 16: Orders Summary

Here are the orders we’ve seen for today (there could be more); this should pretty well do it for the show, though it does continue through Friday and there probably will be a few more deals:

- Airbus: Air Mauritius, MOU for four A350-900s.

- ATR: Myanma Airways, six ATR 72-600s with options for six.

- Boeing: After saying he was in no hurry to finalize the 777X orders, U-Turn Al (Akbar Al-Baker) did just that–Qatar Airways signed the contract for the 50 announced at the Dubai Air Show last November, with 50 options; Qatar also orders and options eight (4+4) 777Fs; Hainan Airlines, MOU for 50 737-8s; MG Aviation Limited, two 787-9s; Air Algerie, two 737-700Cs.

- Bombardier: Nok Air converted two previously held options to firm orders for the Q400; Unidentified commitment from an existing customer for five CSeries; Unidentified order for seven CS300s and added six options; now at 513 orders and commitments.

- CFM: 80 LEAP-1A engines (for A320neo) from Mexico’s Interjet.

Items of interest:

- Ready for a 12 hour flight in the Bombardier Q400 turbo-prop? It will soon be available. Marshall Aerospace sent us this press release:

Auxiliary fuel tanks for Bombardier Q400: Marshall Aerospace and Defence Group and Bombardier Aerospace are developing an External Auxiliary Fuel System solution for the Bombardier Q400 turboprop aircraft.The solution, which will be available as an official Bombardier option, will provide up to an additional 10,000lb of fuel in two external pannier tanks allowing the aircraft to fulfill a whole range of missions requiring additional range and endurance, allowing this turboprop platform to be able to sustain operations of up to 12 hours. - Although Airbus CEO Farbice Bregier said “no” to an A380neo, reported in The Seattle Times and linked by us earlier, today Aviation Week quotes Airbus COO-Customers John Leahy as saying a decision on the A380neo will come next year–which supports our commentary that we didn’t believe the A380neo issue is dead. Airchive reports that A350 chief Didier Evard hasn’t ruled out an A350-1100, either, just as we also noted in our commentary.

- GE wanted to be the sole source on the A330neo, reports Aviation Week, which also explains why Airbus chose Rolls-Royce.

- Flight Global has this story explaining how Airbus plans to be “weight neutral” for the A330neo vs the A330ceo.

Posted on July 16, 2014 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, CFM, CSeries, GE Aviation, Rolls-Royce

737-700C, 737-8, 777-9, 777F, 777X, 787-9, A330neo, A350-900, A380, Airbus, ATR, ATR-72-600, Boeing, Bombardier, CFM, CS300, CSeries, GE Engines, LEAP-1A, Marshall Aerospace, Q400, Rolls-Royce

Farnborough Air Show, July 15: Orders summary

Here are the orders and commitments announced today that we saw–there could be others we haven’t seen:

- Airbus: Avolon (a lessor) ordered 15 A330neos; CIT Aerospace, MOU for 16 A330-900s, five A321neos; SMBC Aviation (lessor), 110 A320neo and five A320ceo aircraft; BOC Aviation, 36 Airbus A320ceo and seven A320neo family 17 of which will be fore the A321 family; AirAsiaX, MOU 50 A330-900s.

- ATR: Air Lease Corp. purchased seven ATR-72-600s.

- Boeing: Intrepid Aviation, 6+4 777-300ERs; Air Lease Corp, six 777-300ERs, 20 737-8s; CIT Aerospace, 10 787-9s.

- Bombardier: One Q400 from Horizon Air; revealed an unidentied customer, Abu Dhabi Aviation, for two Q400s; LOI from Falcon Aviation for five Q400s.

- CFM: Air Lease Corp. ordered the LEAP-1A for 20 A320neo family aircraft.

- Embraer: Azul Air, LOI for 30+20 E-195 E2 (and becomes launch customer for this sub-type); Fuji’s Dream Airlines, 3+3 E-175s, a previously unidentified customer.

- Mitsubishi: six MRJ90s from Air Mandalay.

- Pratt & Whitney: SaudiGulf Airlines orders the V2500 to power four A320ceos; Philippine Airlines executes a previous LOI to a firm order for the GTF for 10 A320neos; BOC Aviation, V2500 for eight of the A320ceo family listed above; International Airlines Group (Vueling Airlines), V2500 for 30 A320ceo family.

- Viking Air: Air Seychelles, two Twin Otters.

Items of note:

- Airbus’ John Leahy says he expects a total of 100 A330neo orders from FAS;

- BOC Aviation endorsed the launch of the A330neo but didn’t (yet) order any.

- Boeing said its new 777X will have a cabin altitude of 6,000 ft, the same as the 787, larger windows than its 777 Classic and the A350; features borrowed from the 787 and many that go beyond the 787 passenger experience; and lower noise.

- Bombardier launched its Q400 Combi, seating 50 passengers and carrying 8,200 lbs of cargo.

- Steven Udvar-Hazy, CEO of Air Lease Corp, which has a large order book for the ATR-72-600, says, the Q400 is a good aircraft, but “much more expensive to operate” vs ATR. [However, that’s at the Q400’s high cruising speed. If it’s throttled back, the operating costs are said by BBD to be comparable.–Editor.]

Posted on July 15, 2014 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, CFM, Embraer, Mitsubishi, Pratt & Whitney

737-8, 777-300ER, 777X, A320ceo, A320NEO, A321NEO, A330-900neo, A330neo, Airbus, ATR-72, Boeing, Bombardier, CFM, GTF, LEAP-1A, Leap-1B, Mitsubishi, Mitsubishi MRJ, MRJ90, Pratt & Whitney, Pratt & Whitney GTF, Q400, Q400 Combi, Twin Otter, Viking Aircraft

Farnborough Air Show, July 14: Orders Summary

Here are orders that were announced on the first official day of the Farnborough Air Show (at least the ones we’ve seen from Seattle–feel free to add to the list if we’ve missed any):

- Airbus: from Air Lease Corp: 25 A330neos and 60 A321neos. British Airways converts 20 A320neo options to firm orders; 20 A320neos from AerCap.

- ATR: NAC places firm order for 75 ATR 42-600s.

- Boeing: Announced what had been leaked before the show–30 737-8s from Monarch Airlines, an important “flip” from incumbent Airbus; six 737 MAX 8s and four Next-Generation 737-800s from Okay Airlines; six 787-9 Dreamliners and five additional 737 MAX 9 from lessor Avolon.

- Bombardier signed LOIs with: Chinese airline Loong Air for 20 CS100s; Petra Airlines of Jordon for two CS100s and two CS300s; and it converted a previously announced LOI for Falcon Air of Abu Dhabi for two CS300s to a firm order. BBD also revealed a previously unidentified follow-on order for three CS300s from Air Baltic. This was announced at the Singapore Air Show.

- CFM International won the large engine order from American Airlines to power its A319neo/A321neo fleet. We reported June 19 that this deal would come down to commercial terms, according to American CFO Derek Kerr. Given CFM’s position on the Boeing 737-800, 737-8 and Airbus A319ceo; and GE Aviation’s presence on AA’s widebody fleet, plus whatever maintenance agreements also exist, CFM/GE was in a position to offer commercial terms that Pratt & Whitney could not when offering the GTF. Also as previously noted, CFM won the easyJet A320neo family order for 270 engines.

- Embraer: 50 “reconfirmable” and 50 options for the E-175-E2 from Trans States Airlines of the USA.

- Mitsubishi: Eastern Airlines signed an MOU for 20 firm and 20 purchase rights for this MRJ90. Parenthetically, we’re happy that Mitsubishi also announced it will test the MRJ in Moses Lake (WA).

- Pratt & Whitney won the GTF order for VivaAerobus’s 40+40 A320 fleet and the V2500 for 12 A320ceos.

Things of note:

- Airbus predicts sales of 1,000 A330neos, plans two year overlap in production of A330ceo. EIS 4Q2017.

The sniping between Airbus and Boeing continues:

- “The only way a passenger will know he’s not on a 787 is that the seats will be bigger,” says John Leahy of the A330neo vs the Boeing 787. Leahy gives good quote.

- Ray Conner, CEO of Boeing Commercial Airplanes, calls the A330 an airplane of the 1980s. (Careful, Ray: the 737 MAX and the 747-8 are airplanes of the 1960s….)

Posted on July 14, 2014 by Scott Hamilton

Odds and Ends: No 90-seat ATR for now; 777X work; JAL says A350 was ‘better;’

No 90-seat ATR: Aviation Week reports that for now Airbus Group, which owns 50% of ATR, won’t green-light a 90-seat ATR turbo-prop due to the adverse impact a development program would have on profits.

Competing for 777X work: Electroimpact is based near Paine Field in Washington and it supplies Boeing and Airbus. It’s interested in participating in the Boeing 777X work. The Everett Herald has this story focusing on the company. Meanwhile, Reuters has this story about the pressures the Airbus and Boeing supply chains are under to cut costs.

JAL: A350 was ‘better:’ Japan Air Lines says its choice of the Airbus A350 was made because the airplane was just “better” than Boeing’s offering. CNBC reports.

No highway in the sky: Just on the ground. See this series of photos to see what we’re talking about.

Posted on March 3, 2014 by Scott Hamilton

Odds and Ends: A350 state loan; Bridging 777 Classic sales; Embraer nabs E2 order; IAM chief speaks out

A350 Loan: The Wall Street Journal reports that Airbus and Germany ended talks about a state loan for the A350 program. Good. Airbus doesn’t need the loan and “divorcing” from state aid frees Airbus to make decisions for the production based on commercial considerations and not politically-driven jobs requirements.

Airbus is considering a second A350 production line to open up slots for the -1000 model. Germany made no secret that this line had to be in Hamburg in exchange for the loan. Our Market Intelligence indicates Airbus may want to locate the line outside Germany and perhaps outside Europe. Ridding itself of continue German meddling is a good thing for Airbus; now it “only” has the unions to deal with.

- In a Guest Column in Aviation Week, Richard Aboulafia continues his A380-bashing, but what he has to say about challenges facing Airbus in the twin-aisle, heart-of-the-market sector bears reading.

Bridging 777s: Jon Ostrower at The Wall Street Journal published this story today about Boeing’s plans to support the 777 Classic sales in advance of the 777X. He reports that Boeing will try to pair 777 Classic orders with the 777X (something we forecast months ago). Boeing is also going to launch a 777 P2F program, persuading airlines to sell their older 777s to cargo carriers and replace them with new 777 Classic orders. This is a challenge because of the continuing softness in the cargo market and plenty of 747-400s available for conversion and 747-400Fs parked in the desert. Such a plan will make it increasingly difficult to support sales of the new-build 747-8F as well.

Although Boeing said it won’t shave the price on the 777 Classic to stimulate sales, we think it will (as it has on the 737 NG).

Embraer nabs E2 customer: Embraer today announced it won an order from an Indian airline for 50 E190 E2s and 50 E195 E2s with options for 50 each. The airline, Air Costa, is a current E1 customer. This is the first E2 order since the launch of the program at the Paris Air Show last June.

Reuters has an article from the Singapore Air Show quoting the Air Costa CEO. The article takes a look at the “small” aircraft market.

IAM chief speaks out: The president of the International Association of Machinists, Tom Buffenbarger, called the Puget Sound Business Journal to talk about the controversial Boeing 777X contract vote.

Why would Buffenbarger do this? He’s facing his first contested election since 1961 and his opponent is from IAM District 751 right here in Seattle. The article makes fascinating reading.

MC-21 profile: A Russian newspaper provides a profile of the Irkut MC-21 (or MS-21 or Yak-242). Talk about confused branding.

Posted on February 13, 2014 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, Embraer, IAM 751, International Association of Machinists, Irkut, YAK

747-8F, 777, 777 Classic, 777X, A350, A380, Air Costa, Airbus, ATR, Boeing, E-190 E2, E-195 E-2, E-Jet E1, E-Jet E2, Embraer, IAM 751, International Association of Machiniists, Irkut, MC-21, Richard Aboulafia, Tom Buffenbarger, Yak-242

Odds and Ends: ATR presses parent Airbus for 90 seat go-ahead; Stratoliner; 777 model

ATR presses Airbus: ATR, the world’s leading maker of turbo-prop airliners, is pressing Airbus Group to green-light its proposed 90-seat, clearn-sheet turbo-prop, Bloomberg News reports.

Airbus Group owns 50% of ATR; Alenia owns the other 50%. ATR’s CEO wants to change this legal structure, reports The Wall Street Journal.

According to the news reports, Airbus is concerned about the diversion of engineering resources. Maybe this is why. Airbus is studying a “mega-twin” concept, reports Aviation Week. Of particular note is the reference that Airbus doesn’t plan to launch a new airplane in the next 10 years. We think these plans are going to have to change when Boeing launches a replacement for the 757, followed by the 737RS, which we have for the end of this decade.

But let’s get back to ATR.

Bombardier, the world’s #2 turbo-prop airliner producer, launched a high-density, 86-seat version of its venerable Q400 last year. China is going forward with a 90-seat turbo-prop and India is also interested in joining the fray.

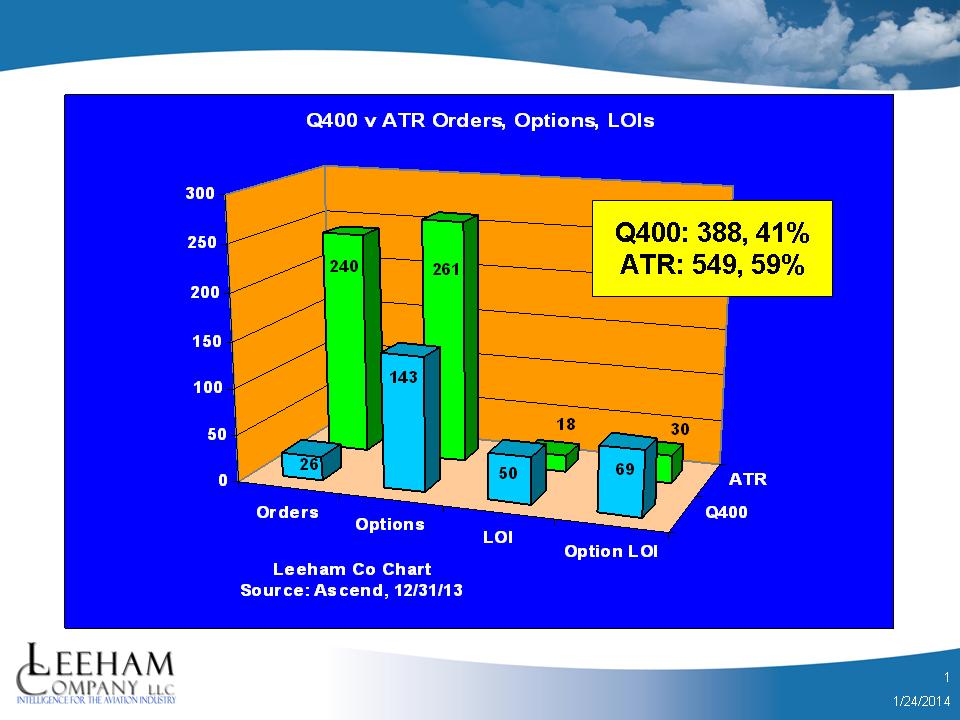

ATR currently holds a 59% share of the future orders, options and Letters of Intents backlog.

Bombardier made some significant progress last year, signing large LOIs with Russia for 100 and with China. These should be converted to firm orders this year, but even so, ATR has a lopsided market lead.

Boeing Stratoliner: Boeing has a short profile of the B307 Stratoliner, the first pressurized airliner. It’s the 75th anniversary of this important airliner. The last surviving example is on display at the Steven Udvar-Hazy Museum at Washington Dulles Airport.

Boeing 777 model: It’s been over the Internet already but in case you’ve missed this, a 1/60th, highly detailed model of the Boeing 777 was carved out of manila folders. This is an amazing piece of artistry.

Posted on January 27, 2014 by Scott Hamilton

Bombardier scores huge deal at Russian air show

Bombardier scored a huge deal at the Russian air show, MAKS, with a letter of intent for an order for up to 100 Q400 turbo-props.

The Q400 has been trailing rival ATR, which is half owned by Airbus parent EADS, for the ATR-72 turbo-prop, by a wide margin in recent sales. ATR recently obtained third-world, gravel runway certification for its airplane.

The BBD deal includes the potential of establishing a second Q400 assembly line in Russia. The BBD deal is for 50+50 and isn’t expected to be completed until next year.

Bombardier has been making a major effort in Russia, placing used CRJ regional jets there, previous orders for the Q400 and an order for 32 CSeries. It’s also signed an agreement to explore customer support services for the Irkut MC-21 150-212 seat mainline jet.

Other MAKS news:

- Russia’s own Sukhoi announced orders for the Superjet, with 100 going to home-grown lessor Ilyushin Finance Corp.

- Russia’s VEB Leasing converted an MOU for 20 MC-21s to a firm order. These are for lease to UTAir and Transaero.

- Airbus, Boeing and Embraer have yet to announce any deals.

- This is the first air show since the Soviet Union collapsed.

Posted on August 28, 2013 by Scott Hamilton

Looking ahead to 2013 in Commercial Aviation

Last year yielded a few surprises in an otherwise predictable year.

Jim Albaugh shocked the aviation world when he retired unexpectedly at age 62. He was expected to remain in his position as CEO of Boeing Commercial Airplanes until mandatory retirement at 65.

EADS CEO Tom Enders unleashed a surprise merger proposal with BAE Systems. The deal didn’t work due to German government opposition, but he ultimately accomplished a governance restructuring—a key objective of the merger—that will reduce government meddling in the future.

Those were about it. Boeing’s much-anticipated Authority to Offer the 777X didn’t happen. ATO for the 787-10 was stealthily granted. Airbus and Bombardier, to no surprise, delayed the A350 and CSeries by a few months. Boeing came roaring back to become sales leader for the first time in about a decade, on the strength of 737 MAX sales.

What’s ahead for 2013? Here’s what we see.

Overview

With the spurt of 737 MAX sales over, narrow-body sales competition between Airbus and Boeing should return to normalcy. Will twin-aisle sales become the next growth market because of the first flight of the A350 and the program launch of the 7870-10? Will ATO of the 777X evolve into a program launch as well? Will Bombardier’s first flight of the CSeries and subsequent testing validate its claims for the new technology airplane and finally spur a large number of sales of the “show me” crowd?

Here’s our OEM-by-OEM rundown.

Posted on January 2, 2013 by Scott Hamilton

Airbus, ATR, Boeing, Bombardier, CFM, Comac, CSeries, EADS, Embrarer, Farnborough Air Show, Pratt & Whitney, Rolls-Royce, Sukhoi

737, 747-8, 767, 777, 777X, 787, A320, A330, A350, A380, Airbus, ARJ-21, ATR, ATR72, Boeing, Bombardier, C919, Comac, Embraer, GEnx, GTF, Irkut, LEAP, Mitsubishi, Pratt & Whitney, Rolls-Royce, SSJ-100, Sukhoi, Trent 1000-Plus

Email Subscription

Twitter Updates

My TweetsAssociations

Aviation News-Commercial

Commentaries

Companies-Defense

Resources

YouTube

Archives

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008